TT Account: Your Guide To Managing Your Account

What is a tt account?

A tt account is a type of investment account that allows investors to trade stocks, bonds, and other securities. It is similar to a regular brokerage account, but it offers some additional benefits, such as lower fees and margin trading.

Tt accounts are typically offered by online brokerages. They are a good option for investors who want to trade frequently and who are comfortable with the risks involved. Margin trading allows investors to borrow money from their broker to purchase securities. This can increase the potential profits, but it also increases the risk of losses.

- Exciting Dive Into Investigation Partners Season 3 Enthralling Cases And Insights

- Air Astana Engine Incident Investigation Reveals Potential Risk

Tt accounts have become increasingly popular in recent years. This is due in part to the rise of online brokerages, which have made it easier for investors to open and manage their accounts. Tt accounts also offer a number of advantages over traditional brokerage accounts, such as lower fees and margin trading.

Tt account

A tt account is a type of investment account that offers a number of benefits, including lower fees and margin trading. It is a good option for investors who want to trade frequently and who are comfortable with the risks involved.

- Benefits: Lower fees, margin trading

- Risks: Margin trading can increase the risk of losses

- Popularity: Tt accounts have become increasingly popular in recent years

- Online brokerages: Tt accounts are typically offered by online brokerages

- Comparison: Tt accounts offer a number of advantages over traditional brokerage accounts

- Suitability: Tt accounts are a good option for investors who want to trade frequently

Overall, tt accounts offer a number of benefits for investors who want to trade frequently. However, it is important to be aware of the risks involved before opening a tt account.

- David Mccallums Children A Look Into The Family Life Of The Actor

- Was Teddy Swims Incarcerated The Truth Unraveled

Benefits

Tt accounts offer a number of benefits, including lower fees and margin trading. These benefits can make tt accounts a good option for investors who want to trade frequently and who are comfortable with the risks involved.

- Lower fees: Tt accounts typically have lower fees than traditional brokerage accounts. This can save investors money, especially if they trade frequently.

- Margin trading: Margin trading allows investors to borrow money from their broker to purchase securities. This can increase the potential profits, but it also increases the risk of losses.

The combination of lower fees and margin trading can make tt accounts a good option for investors who want to trade frequently and who are comfortable with the risks involved. However, it is important to be aware of the risks before opening a tt account.

Risks

Margin trading is a risky investment strategy that can lead to substantial losses. This is because when you trade on margin, you are borrowing money from your broker to purchase securities. This means that you are essentially magnifying your potential profits and losses.

For example, if you purchase $1,000 worth of stock using margin, and the stock price increases by 10%, you will make a $100 profit. However, if the stock price decreases by 10%, you will lose $100. This is because you are still obligated to repay the $1,000 that you borrowed from your broker, even if the stock price has decreased.

It is important to be aware of the risks involved in margin trading before you open a tt account. Margin trading can be a good way to increase your potential profits, but it can also lead to substantial losses. Only trade on margin if you are comfortable with the risks involved.

Popularity

The surge in popularity of tt accounts can be attributed to several factors, including the rise of online brokerages and the growing popularity of margin trading.

- Online brokerages: The advent of online brokerages has made it easier than ever for investors to open and manage their own tt accounts. In the past, investors had to go through a traditional brokerage firm, which could be a time-consuming and expensive process. However, with the advent of online brokerages, investors can now open and manage their own tt accounts in a matter of minutes.

- Margin trading: Margin trading is a type of investment strategy that allows investors to borrow money from their broker to purchase securities. This can increase the potential profits, but it also increases the risk of losses. However, many investors are attracted to margin trading because it can provide them with the opportunity to make larger profits than they would be able to make with a traditional brokerage account.

The combination of lower fees and margin trading has made tt accounts a popular choice for investors who want to trade frequently and who are comfortable with the risks involved.

Online brokerages

The availability of tt accounts through online brokerages has significantly transformed the investment landscape, providing numerous advantages to traders. Online brokerages have played a pivotal role in the growing popularity of tt accounts, offering several key benefits that have resonated with investors.

- Convenience and Accessibility: Online brokerages offer a convenient and accessible platform for investors to open and manage their tt accounts. The streamlined account opening process and user-friendly interfaces make it easy for individuals to get started with tt trading, eliminating the need for traditional brokerage firms.

- Lower Fees and Commissions: Online brokerages typically charge lower fees and commissions compared to traditional brokerages. This cost advantage allows traders to save money on trading activities, maximizing their potential profits.

- Advanced Trading Tools and Platforms: Online brokerages provide advanced trading tools and platforms that cater to the needs of tt account holders. These platforms offer real-time market data, charting capabilities, and sophisticated order types, empowering traders with the necessary resources to make informed trading decisions.

- Educational Resources and Support: Many online brokerages offer educational resources and support to help tt account holders enhance their trading knowledge and skills. This includes access to webinars, tutorials, and market analysis, enabling traders to stay updated on market trends and make more informed trading decisions.

In summary, the partnership between online brokerages and tt accounts has fostered a dynamic and accessible trading environment. Online brokerages have made tt trading more convenient, cost-effective, and accessible, while providing traders with advanced tools and support to navigate the markets effectively.

Comparison

Tt accounts offer a number of advantages over traditional brokerage accounts, including lower fees, margin trading, and advanced trading tools. These advantages can make tt accounts a good option for investors who want to trade frequently and who are comfortable with the risks involved.

- Lower Fees: Tt accounts typically have lower fees than traditional brokerage accounts. This can save investors money, especially if they trade frequently.

- Margin Trading: Margin trading allows investors to borrow money from their broker to purchase securities. This can increase the potential profits, but it also increases the risk of losses.

- Advanced Trading Tools: Tt accounts often offer advanced trading tools that are not available with traditional brokerage accounts. These tools can help investors to make more informed trading decisions.

Overall, tt accounts offer a number of advantages over traditional brokerage accounts. These advantages can make tt accounts a good option for investors who want to trade frequently and who are comfortable with the risks involved.

Suitability

Tt accounts are a good option for investors who want to trade frequently. This is because tt accounts offer a number of advantages over traditional brokerage accounts, including lower fees, margin trading, and advanced trading tools.

- Lower Fees: Tt accounts typically have lower fees than traditional brokerage accounts. This can save investors money, especially if they trade frequently.

- Margin Trading: Margin trading allows investors to borrow money from their broker to purchase securities. This can increase the potential profits, but it also increases the risk of losses.

- Advanced Trading Tools: Tt accounts often offer advanced trading tools that are not available with traditional brokerage accounts. These tools can help investors to make more informed trading decisions.

Overall, tt accounts offer a number of advantages over traditional brokerage accounts. These advantages can make tt accounts a good option for investors who want to trade frequently.

Frequently Asked Questions about Tt Accounts

This section provides answers to some of the most common questions about tt accounts.

Question 1: What is a tt account?

A tt account is a type of investment account that offers a number of benefits, including lower fees and margin trading. It is a good option for investors who want to trade frequently and who are comfortable with the risks involved.

Question 2: What are the benefits of a tt account?

The benefits of a tt account include lower fees, margin trading, and advanced trading tools. These benefits can make tt accounts a good option for investors who want to trade frequently.

Question 3: What are the risks of a tt account?

The risks of a tt account include the risk of margin trading. Margin trading can increase the potential profits, but it also increases the risk of losses.

Question 4: Who should open a tt account?

Tt accounts are a good option for investors who want to trade frequently and who are comfortable with the risks involved.

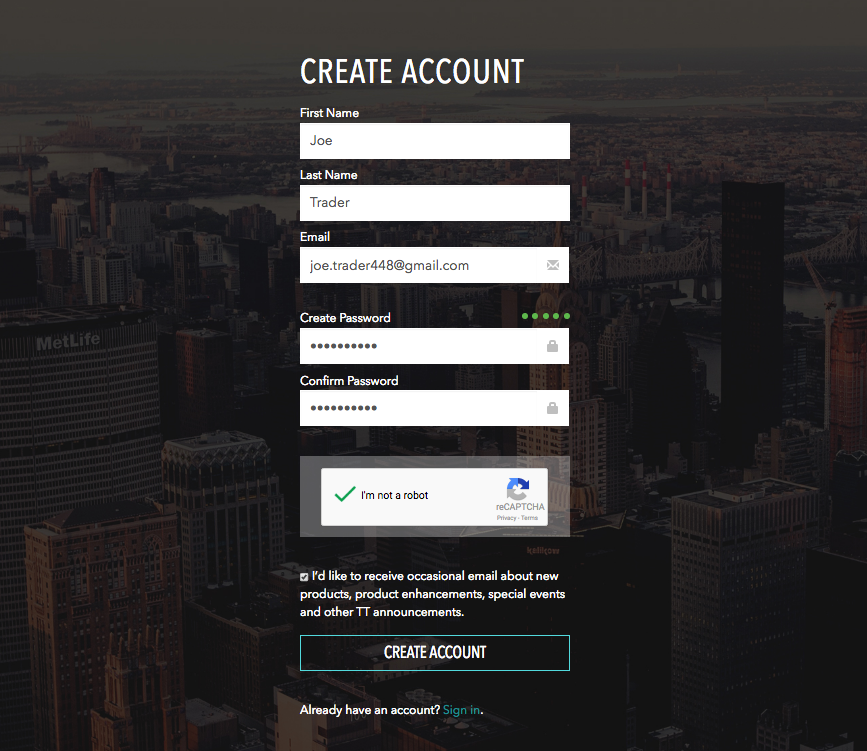

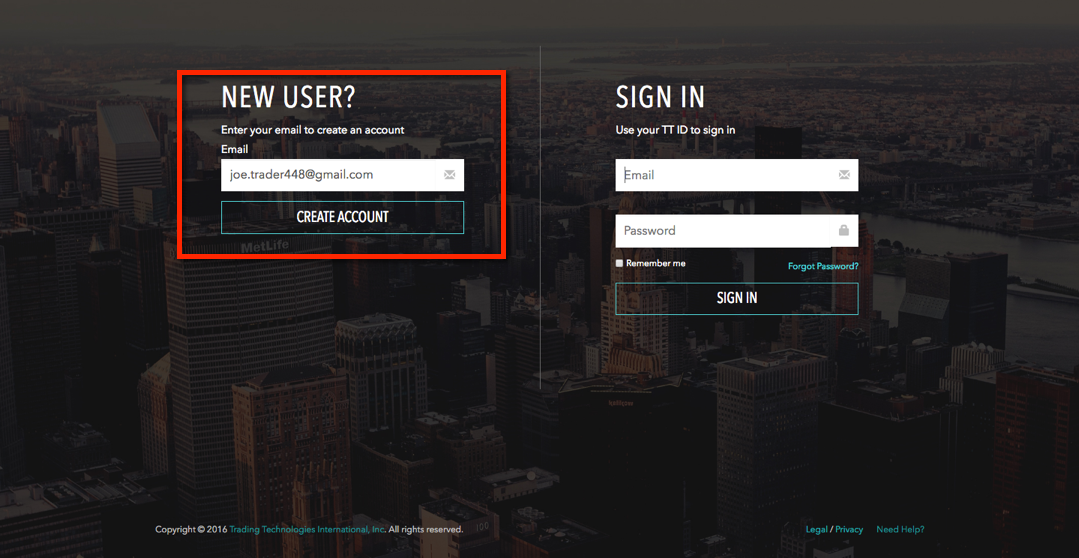

Question 5: How do I open a tt account?

To open a tt account, you will need to contact a broker that offers tt accounts.

Question 6: What are the fees associated with a tt account?

The fees associated with a tt account vary depending on the broker. However, tt accounts typically have lower fees than traditional brokerage accounts.

Summary: Tt accounts offer a number of benefits for investors who want to trade frequently. However, it is important to be aware of the risks involved before opening a tt account.

Next Article Section: Benefits of Tt Accounts

Tt Accounts

In conclusion, tt accounts offer a unique set of benefits that make them an attractive option for active traders. With lower fees, margin trading capabilities, and advanced trading tools, tt accounts provide investors with the resources they need to navigate the markets effectively.

Whether you are a seasoned trader or just starting out, understanding the intricacies of tt accounts can empower you to make informed investment decisions and potentially enhance your trading performance. As the financial landscape continues to evolve, tt accounts are poised to remain a valuable tool for savvy investors seeking to maximize their trading opportunities.

Detail Author:

- Name : Muriel Ratke

- Username : eleonore19

- Email : dschmidt@schultz.com

- Birthdate : 1989-12-09

- Address : 32030 Christy Ramp Suite 650 Tellyland, NE 94696

- Phone : 845-651-9224

- Company : Towne and Sons

- Job : Radio Mechanic

- Bio : Maxime quis et pariatur quas ea vel in. Magni amet eum qui. Ratione neque ut exercitationem perferendis. Est quod vitae facere recusandae omnis in voluptatem quis.

Socials

twitter:

- url : https://twitter.com/lauryn_hermiston

- username : lauryn_hermiston

- bio : Beatae repellendus provident sapiente voluptas. Possimus laudantium omnis ut maiores dolores nesciunt nostrum veritatis. Fugiat hic pariatur odit dolorem.

- followers : 3422

- following : 664

linkedin:

- url : https://linkedin.com/in/lauryn.hermiston

- username : lauryn.hermiston

- bio : Quo aut eum enim praesentium illo.

- followers : 4022

- following : 2914

tiktok:

- url : https://tiktok.com/@lauryn_hermiston

- username : lauryn_hermiston

- bio : Doloribus consequatur quis vel eum est eaque. Sit rem ut rerum et officia.

- followers : 3214

- following : 2199

instagram:

- url : https://instagram.com/lauryn_dev

- username : lauryn_dev

- bio : Ipsa et sint est quasi quia vitae. Culpa et assumenda hic est dicta. Id veniam sit quas.

- followers : 5113

- following : 25